In the future, I had gotten a number of payments within the mail and thought I’d add up the full of all my debt simply out of curiosity.

It totaled over $18k.

I bear in mind being so CONFUSED.

Wait…I used to be in $18,000 value of debt? The place was it?!

I seemed across the cellular dwelling trailer that I used to be dwelling in. That was $24k and I didn’t even rely that quantity within the $18k.

How might I probably have that a lot debt? The place did it go? The place was it? I didn’t have something helpful.

I used to be so ashamed. Right here I used to be, working in banking as a senior teller, dealing with different folks’s cash, and my OWN cash was an entire and utter mess.

I didn’t need to know the reply of the place all of it went. I used to be in denial. Ashamed and embarrassed. I didn’t need to know something. I wished to maintain my head in the dead of night, like an ostrich within the sand.

Nevertheless it haunted me. I had cash. It wasn’t that I didn’t have cash. My husband on the time and I had been doing high-quality. Each of us working, we had a pair hundred {dollars} left over each month however we simply weren’t getting forward.

We couldn’t take holidays like we wished. Go to the locations we wished. I needed to work 40 hours every week, he labored 40 hours every week.

However one thing inside me stated I wished extra. No more cash, however a special life. I didn’t need to be in debt. All my mates had been in debt. It appeared so widespread, however I didn’t need to be. I wished to be DIFFERENT.

However the quantity was overwhelming and whereas I attempted for a bit of bit to get out of debt, my husband wasn’t on board. He spent each penny further we had. So as to have the ability to spend some cash myself, I spent my cash and we simply by no means did something in regards to the debt.

We had been younger and thought that the debt would magically disappear after we obtained older.

Nevertheless it didn’t.

And shortly sufficient, we began making an attempt to have youngsters and I had my first youngster, a wholesome child woman.

That’s when every thing modified.

I wished to remain HOME with my child! I couldn’t think about somebody ELSE elevating MY child. Somebody ELSE’S palms holding her. Somebody ELSE’S hugs. Somebody ELSE touching her and coddling her. Some stranger. I wished to do this. I wished to be along with her.

However at that time, we had been silly for years. The debt was a lot. It now totaled over $30k PLUS our $55k home, grand whole of $85k.

I wished to be sick. Simply fascinated about it NOW, scripting this to you right now, makes me really feel so queasy. That was my life. In debt, with youngster, nowhere to go, nothing to do. My husband couldn’t assist us. He didn’t make as a lot as we would have liked. I knew I didn’t need to work, so my answer was to get out of debt.

Making more cash wasn’t the reply. No matter extra we made, he’d simply spend it. What’s the purpose of constructing more cash if what you could have all flies out the window. No. Getting out of debt was the reply.

If I stayed dwelling, I might get out of debt, then he wouldn’t complain and every thing could be higher. All of the stress could be gone. We might afford a home with warmth and air con (we had a fire, that was it- in a metropolis that will get beneath zero within the winters and no air con in any respect.)

So I mustered up my braveness that actually took me YEARS to construct up and I created a worksheet for myself. “Let’s begin at floor zero,” I believed to myself.

I didn’t come up with the money for to purchase Dave Ramsey’s program, however I did learn someplace in regards to the debt snowball plan so I attempted to implement it.

I obtained inventive and made my DIY spreadsheet/worksheet and began working, as he advised on the time, to repay the very best rate of interest mortgage. For me, that occurred to be essentially the most highest mortgage AMOUNT. I attempted for just a few months, however not seeing the full go down quick sufficient, sadly, I give up. Thanks Dave.

I gave up. I couldn’t do it. I wasn’t getting ANY WHERE!!!! I used to be SOOO mad. So annoyed. I felt like, there was NOTHING I might do. Fully aggravated. I wanted assist however couldn’t discover any assist wherever.

Sleep disadvantaged from a brand new child, a husband that refused to assist with caring for her (AT ALL!) I felt alone. Fully alone, afraid, and with none choices.

But when I wished a greater life, I HAD to get out of debt. I simply HAD TO!!!

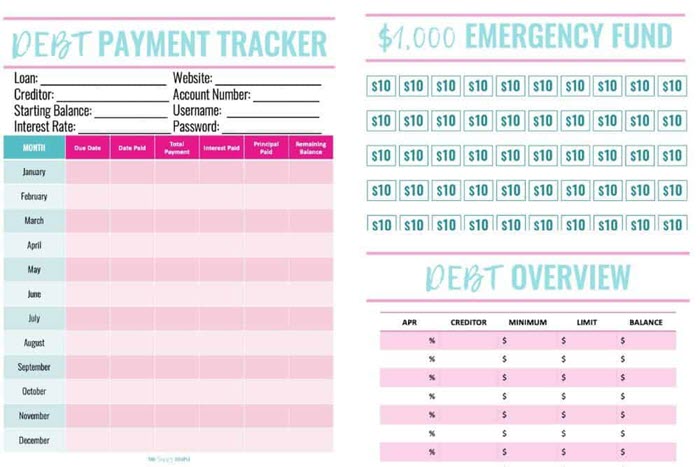

So I created a NEW worksheet (this can be a prettier model of that one)!

Obtain the Debt Cost Tracker free printable right here.

I made a decision to begin paying on the LITTLEST quantity invoice. It was round $500 and took me 3-4 months to pay it off.

After I paid off that invoice (it was the LOWEST rate of interest), I felt like I completed one thing. Now, we had $60/month further from THAT invoice’s minimal fee and I might put it on the following invoice. No drawback.

I began engaged on the following invoice. It was round $1,500. I began paying it off little by little and after IT was paid, began the following and so forth.

Quite a bit has occurred in my life since then. My husband deserted me and the youngsters (we now have two) and I ended up homeless, in round $30k debt at the moment.

However now by myself, after I obtained a spot, I might repay debt MYSELF, with out him thwarting the plans, spending cash, and so on.

Lastly, that final fee was made, $5k to that final invoice (the very best curiosity one). I used to be a co-signer on HIS mortgage and he was not making funds so it was affecting my credit score. I knew if I wished to get someplace and away from his entanglements, I needed to repay the mortgage FOR him.

I did. Now not was he in a position to maintain my credit score rating as hostage.

I’ve no debt (I do have a mortgage home fee that I take advantage of to construct my credit score and my funds are made mechanically so I by no means have to fret about lacking one). I’ve no bank cards and no debt outdoors of that home fee to assist my credit score rating. I purchased my $27,000 automobile with money.

Actually, I’m dwelling my dream life. It has NOT occurred in a single day. It took years and years and years as a sluggish and constant sample and behavior to get out of debt, but it surely was value it.

As a result of now I CAN have my dream life BECAUSE I caught with it. And that’s my finest recommendation to you right now.

You’ll want to surrender.

You’ll want to give up.

You’ll want to throw within the towel.

You’ll get unmotivated.

Issues will go fallacious.

You’ll get off monitor.

However I would like you to recollect one factor: you may’t HAVE your dream life when you give up.

I didn’t get to the place I’m right now by quitting and you may’t both. Yeah, issues get powerful, hold going. Yeah, you’ll fail miserably. All of us mess up. Hold going.

Work on the SMALLEST mortgage quantity FIRST. Why? It’ll hold you motivated! You see progress. You see payments being paid off and it’s nice.

It’s like beginning to eat wholesome. Until you see you’re reducing weight, defining your physique, you’re not going to keep it up. We, as people, must see RESULTS.

Beginning with the smallest quantity mortgage helps you see these outcomes shortly.

So for me, this debt payoff printable above obtained me out of $30k+ debt!

Perhaps it’s not the proper plan for you. Pay attention, that’s OKAY! So long as you discover one thing that works for you, that’s completely high-quality. Right here’s extra actually cool printables that assist with debt, credit score, and all issues cash associated.

These printables may match higher for you, no drawback, however the bottom line is to keep it up. Don’t surrender in your goals, since you are value getting them! I by no means imagined I’d be capable to get this far, from homeless, in debt $30k+ to now working two multi-million greenback empires. Not in one million years would I think about my life like this!

I’m actually grateful for all that I’ve and for now having the ability to flip round and assist others get out of debt, earn money, and attain their goals too. It’s wonderful.

Think about how a lot good you are able to do on this planet when you had been fully out of debt! How many individuals you possibly can assist. What number of lives you possibly can serve. Nevertheless it begins with getting out of debt. Use whichever debt printable you need, simply USE ONE! Decide one, anybody.

220+ Web page Budgeting Cash Binder {Sarah Titus}

This Budgeting Cash Binder is packed stuffed with every thing it’s good to handle your cash higher! It’ll let you know precisely what to trace, show you how to set targets and pay of your debt and a lot extra!!!

Free Debt Reimbursement Printables {Sugar, Spice, And Glitter}

When you collect and fill all the data for every of your money owed, this debt compensation tracker won’t solely show you how to keep organized but in addition have a transparent overview of your funds and all the time be ready for the following one.

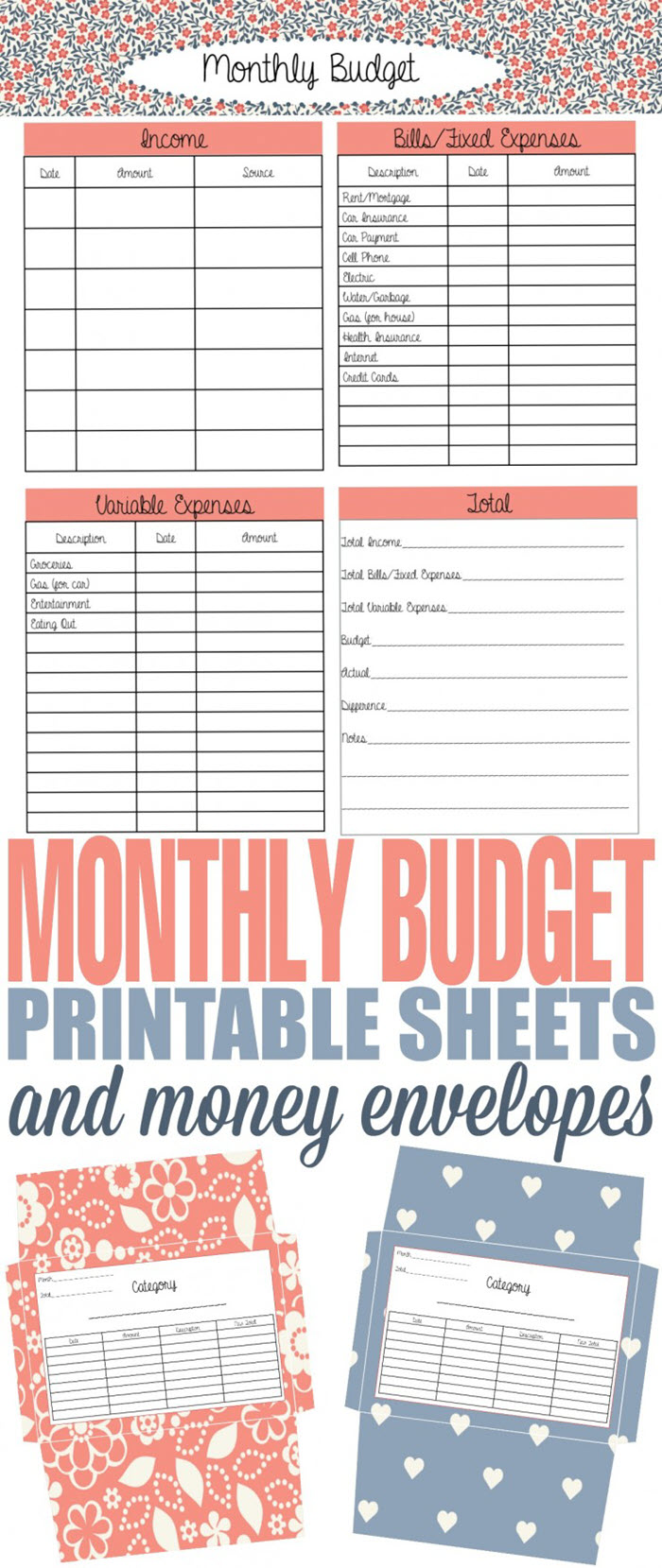

Funds Printables {Blooming Homestead}

It’s really easy to overspend nowadays, which is why it’s so vital to all the time hold monitor of your funds. These beautiful price range printables will make private funds simpler but in addition extra enjoyable!

Monetary Planner Free Printable {Merely Stacie}

This beautiful monetary planner PDF has all of the sheets it’s good to monitor your price range, revenue, bills, debt funds and far more and it will get yearly updates.

How To Funds And Spend Properly With An Envelope System {Frugal Momeh}

Why solely monitor your price range when you may truly plan it forward? The envelope system will show you how to accomplish that and these cute printables are the right strategy to apply it!

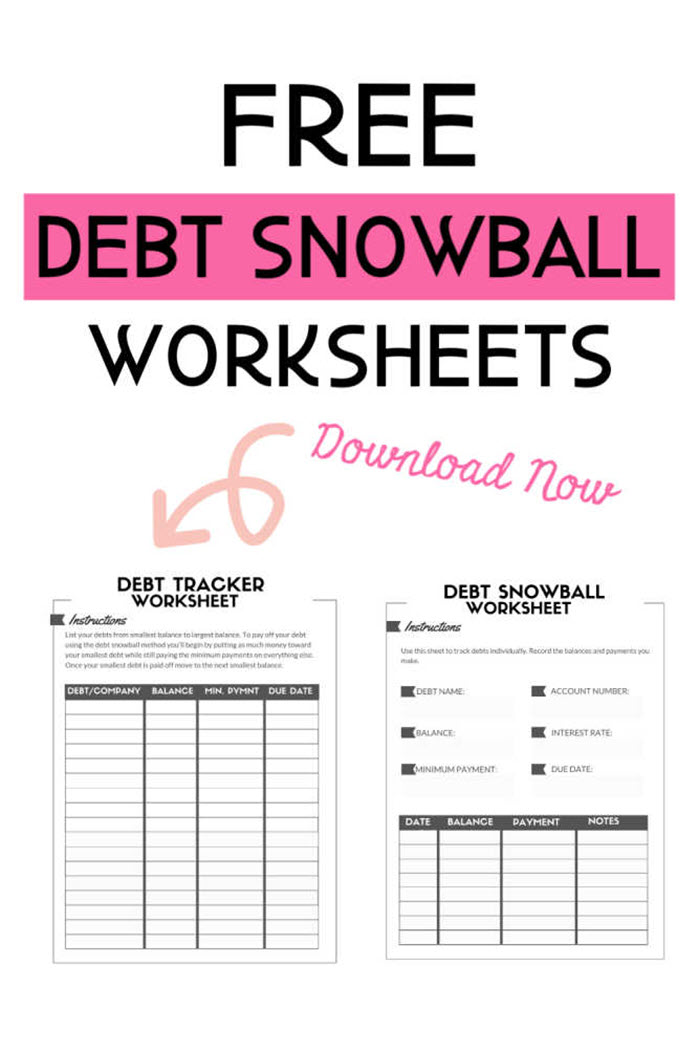

Free Debt Snowball Worksheet {Single Mother’s Revenue}

The debt snowball is a superb technique if that system works for you, to maintain you on monitor when you’re on the highway to turning into debt-free. It could take some time which is why getting small wins regularly is precisely what you could want to stay to your funds.

Free Printable Funds Sheets {Printable Crush}

These colourful price range sheets are additionally tremendous practical and will certainly make private funds a bit easier, particularly when you’re not mates with numbers.

Free Printable Debt Payoff Tracker {The Savvy Couple}

In case you’ve been looking for a clear and easy debt payoff tracker, this one will get the job accomplished. With only one sheet you may hold monitor of your mortgage funds for the complete 12 months!

Printable DIY Money Envelope System {Carrie Elle}

You may shortly make your personal money envelope system with these free printables and hold your spending underneath management all through the complete month.

Credit score Card Debt Free Tracker Printable Worksheet {Melissa Voigt}

Having bank card debt is one thing quite common however there’s all the time a strategy to get out of it! This bank card debt fee tracker would possibly turn out to be useful once you resolve to work your strategy to a debt-free life.

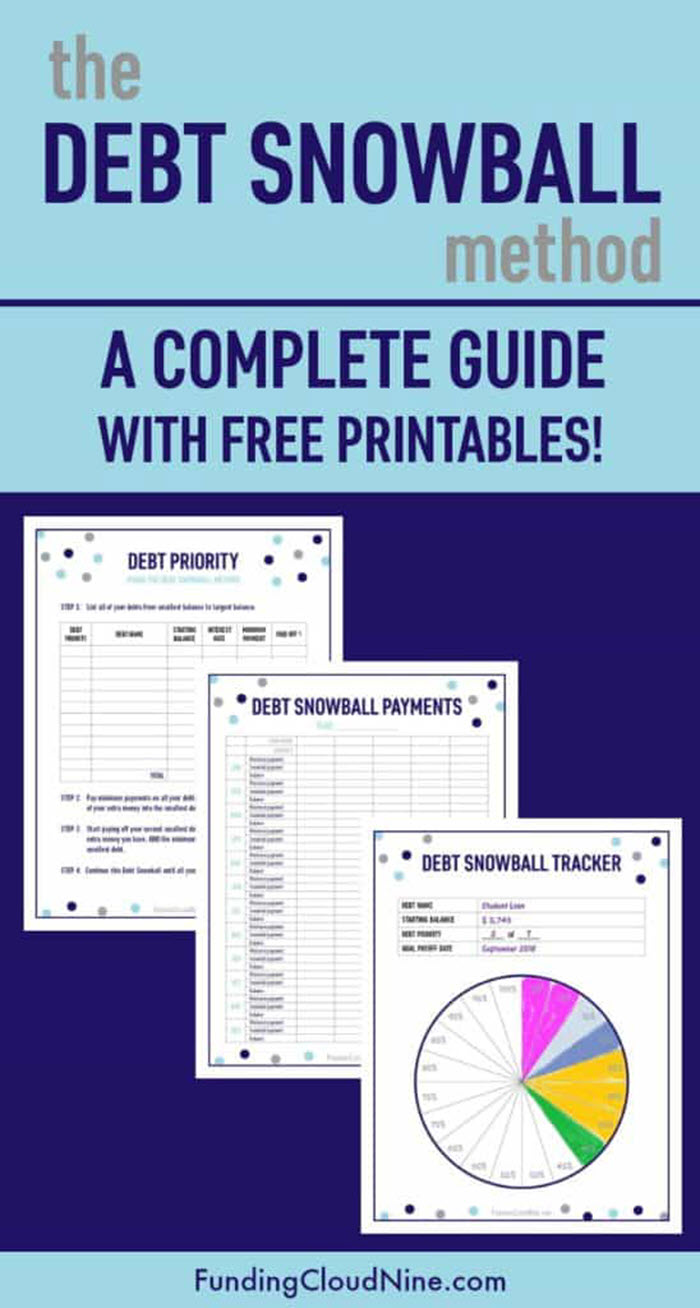

The Debt Snowball Methodology Information With Printables {Funding Cloud 9}

This can be a nice complete information for the debt snowball technique. It can show you how to perceive precisely how you can use it and the included printable charts have good, practical layouts.

Free Want Checklist Printable For Budgeting {Saturday Present}

Planning your future purchases and attainable reductions is a superb means to save cash. These want checklist printables make issues so much simpler as they permit you to hold monitor of the objects you intend on shopping for in addition to their costs.