Google can not seem to sit nonetheless in the case of its manufacturers and providers. This time, Google Pay (also referred to as GPay) and Google Pockets are as soon as once more switching locations in accordance with an e mail despatched to Google Pay customers on Thursday.

In 2011, the corporate made its first enterprise into cellular funds with the Google Pockets app for Android. Sooner or later, it moved tap-to-pay performance to a brand new app referred to as Android Pay, leaving Google Pockets to deal with solely peer-to-peer funds. In 2018, the 2 providers merged again into an all-in-one app referred to as Google Pay. Issues acquired complicated once more in 2022 as Google Pockets was reintroduced with Google Pay now serving as a quasi-accounting app and loyalty program tracker in america. Confused but? Us too.

Come June, although, Google Pay will formally be no extra. This is what it’s good to know concerning the imminent disappearance of Google Pay.

What’s Google Pockets, how does it work, and which banks help it?

Google Pockets is the corporate’s handy cost system for Android customers, beforehand referred to as Android Pay.

What’s Google Pay?

As of 2022, the Google Pay app, or GPay as you will discover it in your telephone, solely exists in america and, of all different locations, Singapore. Within the 40-odd different areas the place Google is concerned in cellular funds, these customers solely get the Google Pockets app.

GPay permits customers to hyperlink their numerous financial institution and credit score accounts to assist them maintain monitor of their spending. As well as, GPay additionally acts as a portal for Google-provided money again rewards at numerous nationwide chains in addition to native shops and eating places. Money again rewards accumulate as a devoted steadiness inside GPay. Customers can even ship cash to or request it from different GPay customers.

What’s occurring to Google Pay?

The corporate notified US Google Pay customers through e mail in late February that the app would shut down on June 4, 2024. This is what which means for GPay’s numerous features:

- Beginning February 22, money again offers can’t be activated. Money again offers which have but to be processed will nonetheless be processed.

- Peer-to-peer funds will now not be provided as of June 4.

- If in case you have a Google Pay steadiness, you should use the GPay app to switch that cash to a checking account by June 4.

- After June 4, you will nonetheless be capable to use the Google Pay web site to switch GPay balances or take a look at your transactions. You may additionally select to unlink your financial institution accounts.

- If you happen to’ve despatched cash to India and Singapore with the Sensible integration on the GPay app, you will not be capable to see transaction info beginning June 4. Your Sensible account info and historical past stays intact over at Sensible — simply use the Sensible web site or app.

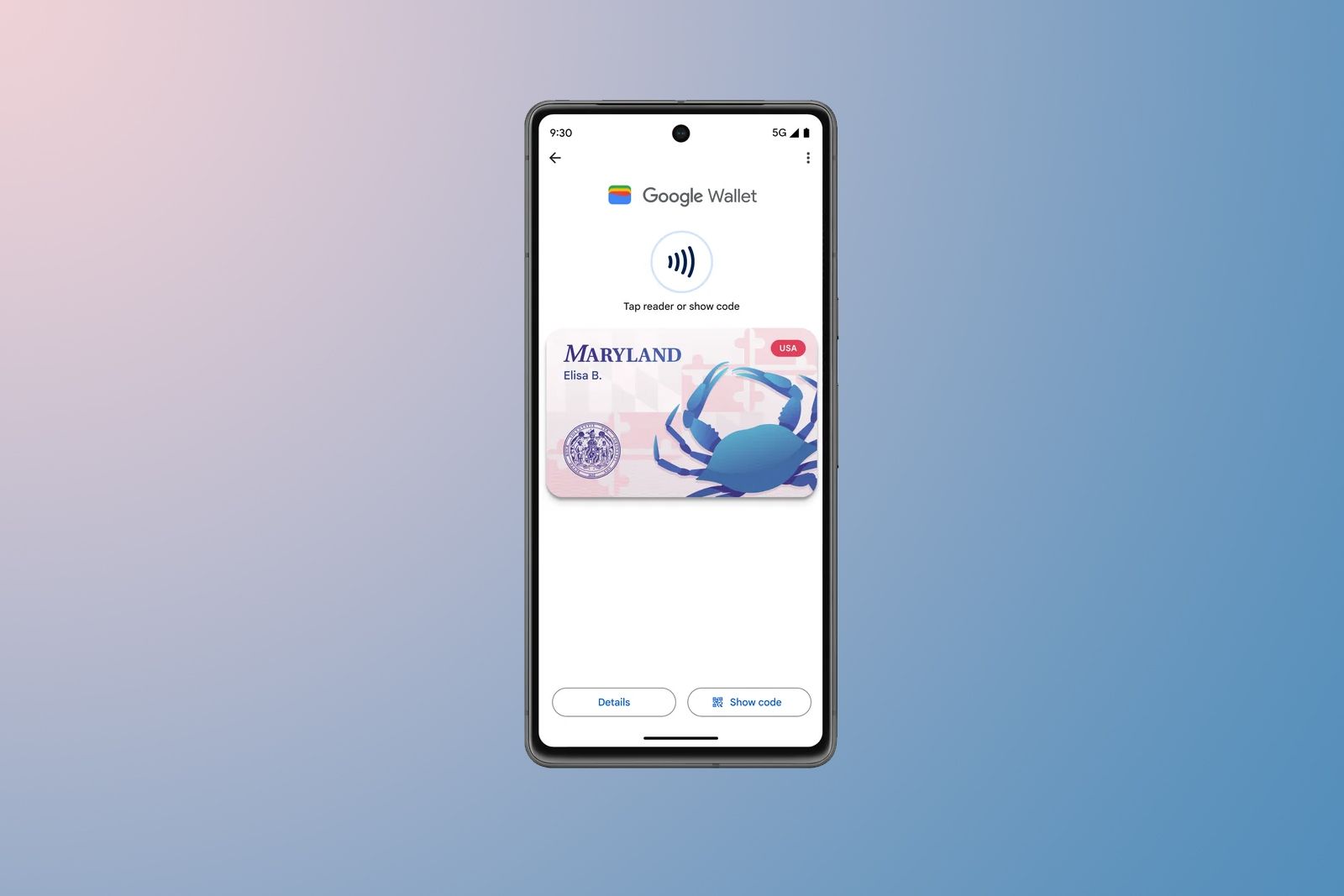

The right way to simply add your driver’s license, insurance coverage, and ID playing cards to Google Pockets

Apple Pockets started supporting digital IDs final yr. Now, Google Pockets is formally doing the identical. This is what it’s good to know and the way it works.

What do I have to do earlier than Google Pay shuts down?

What do I have to do earlier than Google Pay shuts down?

Switch your GPay steadiness

If in case you have a GPay steadiness, you possibly can switch it to a linked checking account. This is what you do:

- Open the GPay app, then choose the right-hand tab on the underside — this might be your Insights tab.

- Close to the underside of the display, faucet in your Google Pay steadiness.

- Choose Switch out.

- Kind within the quantity you are transferring. Faucet Subsequent.

- Choose a checking account you have linked to carry out the transaction. Faucet Switch out.

Transferring to a checking account takes longer than it does to a debit card, however you will pay for a speeider switch as debit transfers incur a 1.5% charge with a minimal of $0.31.

If in case you have a GPay steadiness of underneath $1, you’ll need to prime it off with a minimal of $10 earlier than transferring the steadiness out.

- Open the Insights tab in GPay and faucet in your Google Pay steadiness

- Choose +Add cash.

- Kind within the quantity you are transferring. Faucet Subsequent.

- Choose a checking account you have linked to carry out the transaction. Faucet Add.

Take away financial institution and credit score accounts

If you happen to’re trying to take away cost accounts from GPay, this is how one can do it:

- Within the GPay app, faucet in your Google account avatar within the top-right nook.

- Choose Linked accounts & cost strategies.

- Choose an account you’d wish to take away.

- Faucet on the three-dot icon within the top-right nook and press Take away account. When requested to substantiate, choose Sure, take away.

Once more, you do not have to unlink your accounts from Google Pay, but it surely’s most likely a good suggestion to sanitize any pointless information from the platforms you will not be utilizing.

What about Google Pockets?

What about Google Pockets?

Google Pockets is the corporate’s important app for tap-to-pay transactions. You may additionally be capable to retailer passes, loyalty playing cards, digital IDs, and extra. Sadly, you will not be capable to do a lot of what GPay used to do, so you will most likely should migrate over to different apps to switch any misplaced performance.