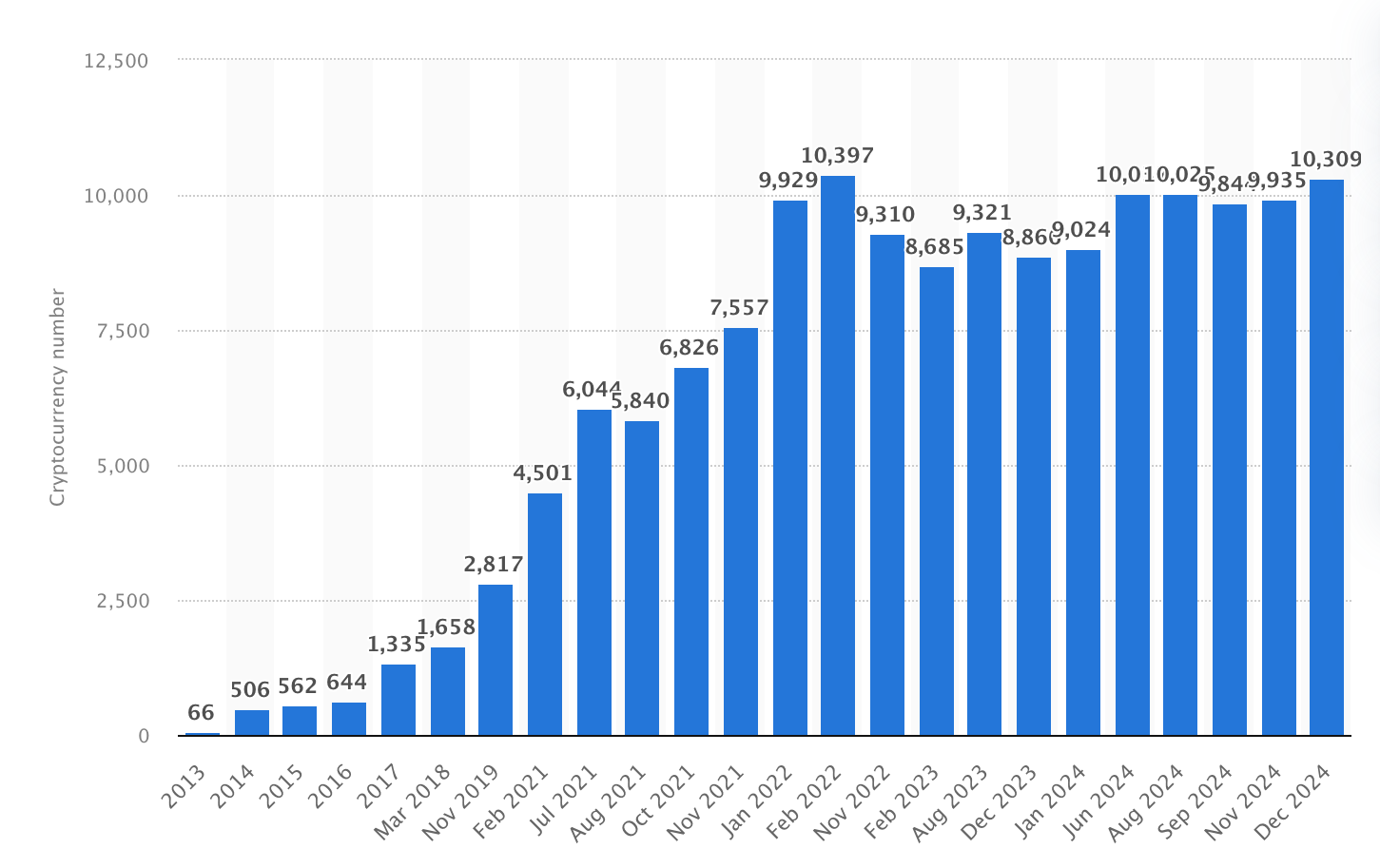

Since the emergence of Bitcoin in 2009, the cryptocurrency market, although not stable, has been gaining momentum.

The growth of the market was accompanied by massive investment inflows, increased curiosity from major enterprises, and of course the emergence of a whole range of new assets.

As of 2024, there are around 10,309 active cryptocurrencies in the world. A large share of these cryptocurrencies, however, are not that significant and popular among crypto owners. And in fact, only 20 cryptocurrencies form 90% of the market.

Nonetheless, for any private individual or company cryptocurrency development can still be a profitable experience. A new crypto unit can help form a unique digital community, augment or replace traditional payments, initiate crowdfunding, and even tokenize physical or virtual assets.

With the right strategy, even smaller projects can carve out a niche in the market and provide real value to users.

In this tutorial, we are going to break down what it takes to create your own cryptocurrency: the process and use cases, problems and traps you might face, and how to overcome them.

What Is Crypto? Types of Crypto

Crypto, short for cryptocurrency, is basically a digital or virtual asset that uses cryptography/encryption to protect transactions.

Unlike traditional (state) money, cryptocurrencies don’t depend on banks or governmental establishments and are hard to fake or counterfeit. They run on decentralized networks, mostly powered by blockchain technology, and are a central component of the Web 3.0 ecosystem.

Besides, crypto doesn’t refer to any particular asset. Crypto holdings normally fall into several types, where some are made for buying and selling and others are created for investing, voting, or governing communities:

- Coins: Coins run on their own blockchains and are usually the primary currency of that network. They’re mostly used for transactions, storing wealth, or powering the system. The most popular representatives of coins are Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Tokens: Tokens, on the other hand, don’t have their own blockchain and are designed for specific applications within decentralized networks. For instance, utility tokens give people access to particular services; security tokens, in turn, are used to represent ownership in a company or asset; and governance tokens (Uniswap) allow holders to vote on critical decisions in decentralized alliances or protocols.

- Stablecoins: Stablecoins (Tether and USD Coin) are tied to fiat assets (e.g., the US dollar) to preserve their value in case of market swings.

- Meme Coins: Just like it sounds, these coins (e.g., Dogecoin or Shiba Inu) are often based on memes or internet culture. They don’t always have serious use cases but can earn popularity just for fun.

Common Use Cases for Cryptocurrencies

Cryptocurrencies have many different uses beyond just being traded or invested in. Here are some of the most popular ways people and businesses use them:

Digital Payments

Cryptocurrencies are gradually becoming a normal way to make payments for various goods and services on the internet, or even in shops.

These payment systems are relatively faster and cheaper compared to traditional systems, especially with international transactions as they do not require banks or payment processing companies.

Cross-Border Payments

Traditional methods to send money across borders normally take time and cost a lot. With cryptocurrencies, however, money transfer is much easier and cheaper.

Sending payments via Ripple (XRP) or, let’s say, Bitcoin is more instantaneous and costs less, which can be beneficial for businesses or people who need to recurrently send a significant amount around the world.

Investment and Trading

Cryptocurrencies are widely used for trading and investment. Many buy coins or other altcoins, hoping that their values will rise in the future. Cryptos can be considered to be like investments (such as stocks or gold) or be traded over a short term to make extra profit.

Smart Contracts and Apps (DApps)

Cryptocurrencies also enable the implementation of smart contracts—automated agreements where the terms are executed independently, which guarantees a fair margin.

Ethereum, in turn, also allows the use of dApps: decentralized applications based on the blockchain to run, for example, financial services or gaming sites without any central governing body.

NFTs (Non-Fungible Tokens)

NFTs are virtual certificates that denote ownership of a certain one-of-a-kind item, such as a piece of art, a soundtrack, or digital artifact. They can be acquired, sold, and traded by people using cryptocurrencies and can serve as a means of proving authenticity.

Decentralized Finance (DeFi)

DeFi employs cryptocurrency to provide a range of classic financial services yet without banks or other central institutions. DeFi is still a growing field where people can use crypto to make interest or take out loans with platforms operating fully on the blockchain.

Gaming and Virtual Goods

Most modern video games allow players to earn, purchase, or barter skins or in-game rewards with cryptocurrency.

Despite all the seeming insignificance, in-game items have tangible value; players can trade them among themselves on different platforms and later convert earnings into fiat currency.

Charity and Donations

Cryptocurrencies are becoming more popular for donations due to their speed and transparency, as well as because a donor can trace where their contribution is going and see it’s being put to proper use.

Identity Verification and Privacy

With rising concerns over personal data, cryptocurrencies and blockchain can protect identities online. Blockchain gives people the chance to control their information themselves and ensure it’s safe when interacting with different digital services.

Is It Legal to Create Your Own Cryptocurrency?

Producing your own cryptocurrency—as with all software development services—is generally legal in most countries, but there are important regulations to be aware of.

While the act of creating a cryptocurrency itself is not prohibited, you must abide by myriad laws depending on the country, the type of cryptocurrency, and how it’s used.

For example, in the US and the UK, creating a cryptocurrency is legal as long as you follow specific decrees regarding business registration, taxes, and financial regulations.

If your cryptocurrency functions like a security or investment, you may need to adhere to securities laws.

Other essential regulations to pay attention to include Anti-Money Laundering (AML) and Know Your Customer (KYC) rules, which prevent fraud and illegal activities.

Additionally, tax laws may require you to report profits from cryptocurrency activities, and consumer protection directives could apply if your currency is used in transactions.

Some countries, however, have banned cryptocurrencies altogether, such as China (still, the country continues to have an active illegal, underground crypto-mining sector)

Nonetheless, it’s essential to research local guidelines or better consult legal experts because, by the time you read this article, you may encounter significant changes.

Ways to Make a Cryptocurrency

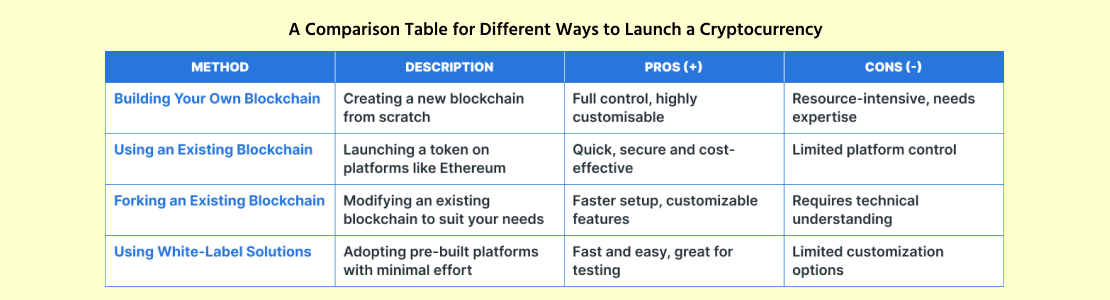

Producing a cryptocurrency is an exciting challenge, but how you approach it depends on your plans, funding, and technical background.

Build Your Own Brand-New Blockchain Network

Building your own blockchain means creating the entire system your cryptocurrency will run on. You’ll plan how transactions function, determine how new coins are minted, and decide how the network will stay protected.

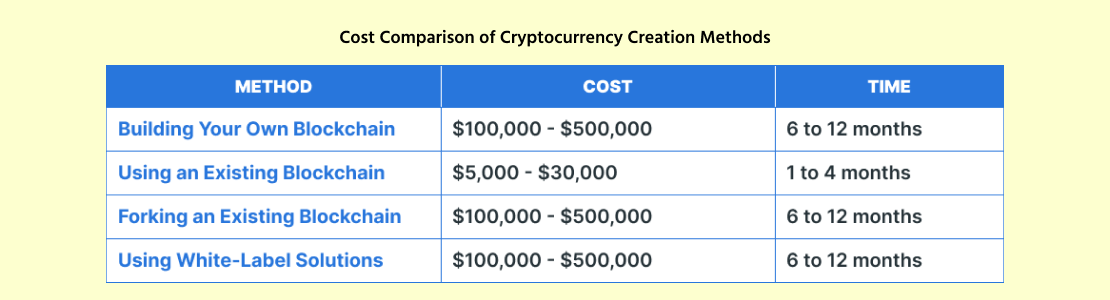

This approach is the most expensive option, costing between $100,000 and $500,000 and taking 6 to 12 months or longer to accomplish. Besides, you’ll need a team of professional architects, security experts, and infrastructure to set up and run the blockchain.

The upside of creating a brand-new platform is that you have full control over every single part of the system. The downside, however, is its resource-intensiveness and profound technical know-how.

Use an Existing Blockchain Platform

Want something faster and more affordable? Opposed to the first option, you can create a token on an existing blockchain, such as Ethereum or Binance Smart Chain.

This option costs around $5,000 to $30,000 and can be done in just 1 to 4 weeks because the blockchain is already in place. All you need is a blockchain developer to develop and test the token and embed a smart contact.

Thus, the benefits include quick setup, low cost, and using a secure platform. However, you don’t have much control over the platform itself and might run into high transaction fees or platform limitations.

Fork an Existing Blockchain

Forking means taking an existing blockchain and making modifications to it to form your own version.

This method is much faster than building a blockchain from scratch; at the same time, you have far more options at your disposal, from how the blockchain processes transactions to how many coins will ever be released.

Forking can cost anywhere from $30,000 to $150,000 and can take about 3 to 6 months, depending on how much you want to customize it. Besides, you still need a skilled team to direct the technical parts and infrastructure setup.

While it is less work than building a blockchain from scratch, forking, nonetheless, requires a strong understanding of blockchain code and might not benefit from future updates to the original blockchain.

White-Label Solutions

White-label solutions are pre-made platforms that allow you to swiftly produce a cryptocurrency with minimal customization. You purchase the software, customize the branding and some features, and roughly this is it.

This option is the cheapest and quickest, costing between $10,000 and $50,000 and taking about 2 to 8 weeks to deploy. There’s little technical knowledge required, as most of the work is already done for you.

The downside is that you have less flexibility to customize your cryptocurrency, as you’re basically using a pre-made template. It’s a great option if you just want a simple, functional token or want to test out the idea before investing more time and money into it.

How to Create a Cryptocurrency: Step-by-Step Process

Creating a cryptocurrency can feel overwhelming, but breaking it into simple steps can make it easier. Here’s a clear and concise guide to help you get started:

Decide Why You’re Making a Cryptocurrency

First, figure out the purpose of your cryptocurrency. Is it for fast payments? Powering a decentralized app? Solving a specific problem? Having a detailed plan will steer the rest of your actions.

Choose How You’ll Create It

You can make your own blockchain (great for unique projects but takes time and resources), modify an existing blockchain (faster and less technical), or create a token on a platform like Ethereum (the simplest option).

Pick How Transactions Are Verified

Choose a consensus mechanism for verifying transactions. It can be Proof of Work (PoW), which is safe but energy-heavy, or Proof of Stake (PoS), which is faster and more eco-friendly. Remember, the consensus mechanism will affect how your cryptocurrency operates.

Plan the Features

Think about the details. How many coins will exist? What security features will it have? Will it be fast and scalable? If you’re making a token, follow the platform’s directions (e.g., Ethereum’s ERC-20 or ERC-721) standards.

Design Your Cryptocurrency

If you’re making a blockchain, you’ll need professional architects to code it from the ground up. For tokens, you just need a smart contract that describes how the token works.

Set Up Wallets

People need wallets to accumulate and utilize their cryptocurrency. You can make it compatible with popular wallets (like MetaMask) or build a new one to match your project’s demands.

Test Everything

Before launching, run plenty of tests to see if everything works. Try out transactions, check for bugs, and make sure the system is invulnerable. Platforms like Ethereum offer test environments to help with this.

Launch Your Cryptocurrency

When you’re ready, release your crypto. Decide how to get it to users—through ICOs (initial sales), free giveaways (airdrops), or listing it on exchanges where people can independently trade it.

Mind the Regulations

Make sure your cryptocurrency adheres to the laws in your target regions, such as anti-money laundering (AML) rules or Know Your Customer (KYC) regulations. Full compliance helps avoid legal trouble later.

Promote and Keep Improving

After the launch, spread the word about your cryptocurrency through social media, websites, and partnerships. Build a community of users and keep updating your project to add features and fix issues.

Challenges in Cryptocurrency Development and How to Overcome Them

Of course, creating any cryptocurrency is exciting, yet it embodies its challenges. Understanding those problems is the key and solution to building a successful and trusted cryptocurrency.

The largest obstacle includes a number of technical difficulties that arise in making a cryptocurrency, especially when you must create a new blockchain from scratch, which requires knowledge of blockchain technology, coding, and security systems.

Security risks are another common problem. Cryptocurrencies and the platforms they run on are frequent targets for hackers. Weaknesses in smart contracts, wallets, or the blockchain can lead to massive losses.

According to the 2024 Crypto Crime Report, over $1.7 billion in cryptocurrency was swiped in 2023 ($3.8 billion in 2022)

To prevent this, you should center around strong security measures, such as systematic audits, updates, and hiring cybersecurity experts.

Regulatory compliance remains one of the unresolved problems from year to year. Different states have different laws and views on virtual assets, and not obeying them can lead to disastrous consequences.

To stay on the safe side, it’s vital to work with legal experts and never disregard Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Although not to the same level as previous problems, scalability problems may still arise. When lots of people start using it, slow transaction speeds and high fees can discourage users.

Choosing Proof of Stake (PoS) or second-layer solutions like sharding can visibly help your system tolerate larger volumes without slowing down, still, it’s necessary to hold expandability under control.

Standing out in a crowded market can also be tough. Thousands of cryptocurrencies already exist, so drawing new users can be nearly impossible without extra financial injections.

The least you can do to succeed is to focus on creating something exclusive that solves real problems.

Besides, pay attention to wallet and exchange integration. Without compatibility with wallets like MetaMask or listings on major exchanges, users might find it hard to access and trade their cryptocurrency.

How Much Does It Cost to Create a Cryptocurrency?

The creation of a cryptocurrency can be costly, but the cost depends on the type of cryptocurrency you want to create and the complexity of the project.

If you decide to create a token on an existing blockchain, such as Ethereum or Binance Smart Chain, it’s the most inexpensive option, typically costing between $5,000 and $30,000.

The main work here involves mainly setting up a smart contract, which is relatively straightforward and doesn’t require building an entire blockchain from scratch.

If you want a custom blockchain—a completely new and unique system—the budget requirements will rise sharply. This can cost anywhere from $100,000 to $500,000, depending on how complex the blockchain is.

Custom blockchains require more development work, such as designing the network, choosing a consensus mechanism, and adding corresponding security measures.

A large part of the cost comes from hiring a development team. You’ll need blockchain architects, security experts, and project managers to devise and oversee the project.

Developers typically charge $50 to $200 per hour, according to their background and location. For a medium-sized project, development labor costs could range from $20,000 to $100,000.

Adding unique elements to your cryptocurrency, such as advanced security or faster transaction speeds, will also increase the cost.

Based on the functions you seek, this could add between $10,000 and $50,000 to the total. If you want to create a cryptocurrency wallet, implement advanced privacy features, or embed scalability solutions, then the price goes up further.

Legal advice and paperwork for the project can cost anywhere from $5,000 to $25,000, depending on where your cryptocurrency is going to be launched and the regulations it must follow.

Other major expenses come from marketing and promotion. No one will know about your digital currency without a good marketing effort, which can cost upwards from $5,000 to $50,000 for a full-scale marketing program.

If you want to list your cryptocurrency on major exchanges, be prepared for listing fees, which can range from $2,000 to $500,000 based on the exchange you choose.

From the launch of your cryptocurrency, there are other maintenance costs involved. This will include updates, security checks, and customer support, with an estimated annual cost between $10,000 and $50,000.

Overall, the cost of cryptocurrency creation services can range from a few thousand dollars for a basic token to hundreds of thousands for a fully custom blockchain with advanced features.

It is important to evaluate your project’s objectives, features, and requirements very early in the development stage to keep costs under control.

Why Choose SCAND for Cryptocurrency Development Services?

SCAND is an expert in cryptocurrency development with over 20 years of experience in software and blockchain solutions. Our team develops custom cryptocurrencies, tokens, wallets, and blockchain platforms to match your needs.

We pay much attention to security and adherence to legal norms to make your cryptocurrency correspond to international standards, such as KYC and AML.

When you hire blockchain developers from SCAND, you get a team that keeps in close contact with a client, maintaining open lines of communication and adapting services to fit the purpose, budget, and timing of a project.

FAQ

Do I need blockchain expertise to develop a cryptocurrency?

Not at all. When you work with a skilled team like SCAND, they handle all the technical stuff, so you can focus on your business and goals instead.

What industries can benefit from custom cryptocurrency solutions?

Pretty much any industry! Cryptocurrencies can make a difference in finance, healthcare, gaming, e-commerce, logistics, real estate, and more by simplifying processes and helping businesses connect with their users.