It is no secret that the most stable and constant characteristic of crypto markets is their volatility.

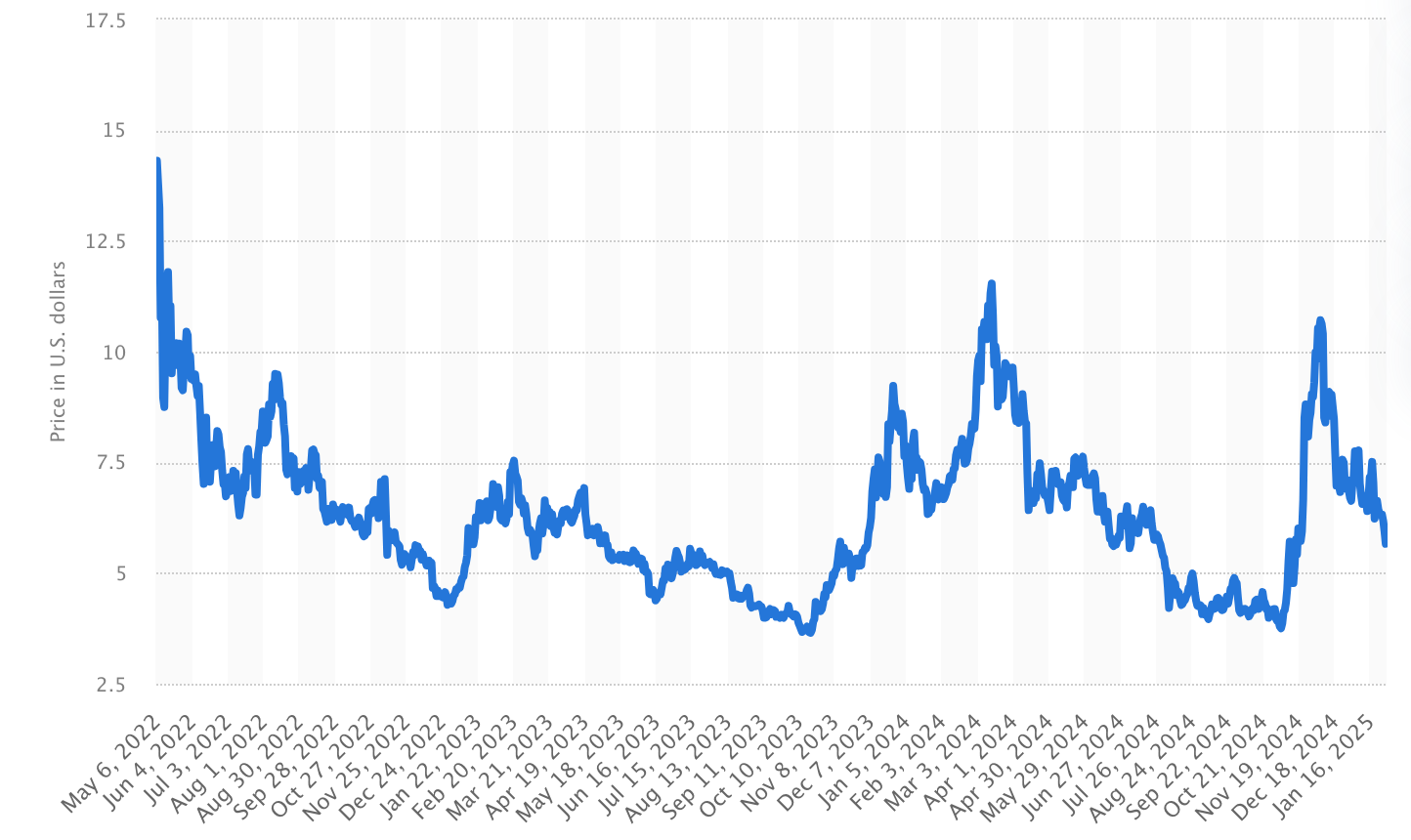

The value of Polkadot, for example, cost $9.36 in the first year, which was 199.85% up from its initial release. The best year for Polkadot was 2021 when the price reached its maximum of $54.87. As of January 29, 2025, one DOT token was only worth $5.76 dollars.

Polkadot price fluctuations (May 2022-January 2025), Statista

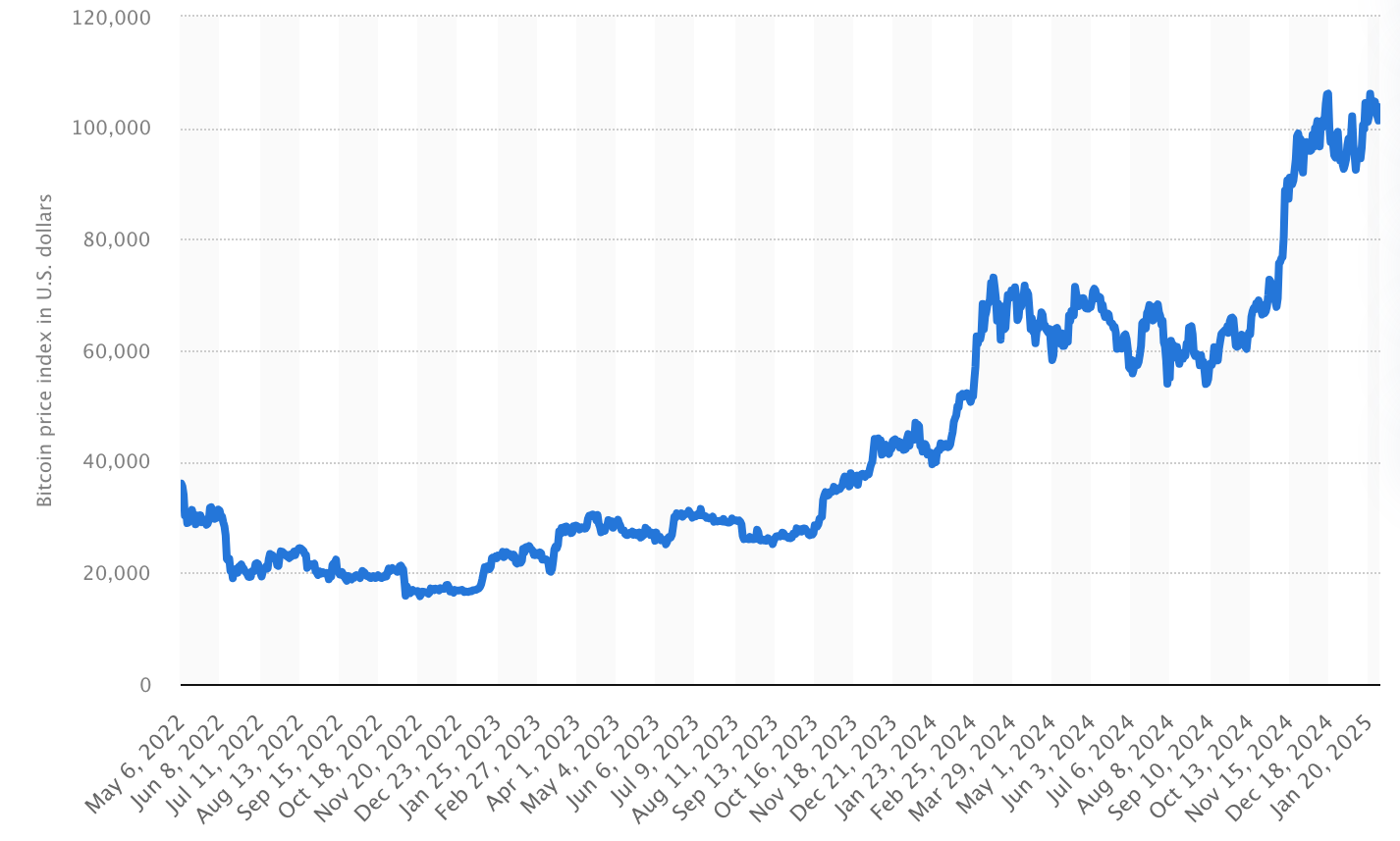

Bitcoin and Ethereum, which together make up more than half of the crypto market, were never particularly stable either.

The first exchange rate of Bitcoin detected, for instance, was $134.40. Subsequently, its price has repeatedly risen and fallen, varying from $70.15 to $106,744.

Bitcoin price fluctuations (May 2022-January 2025), Statista

Ethereum, in turn, started at $2.92, then once dropped to $0.4457 (October 2015), and even reached $4,786 in November 2021.

Seeing how risky and at the same time profitable (if you catch the moment) the crypto market can be, traders began to look for auxiliary tools when trading. One of the most efficient means has become sandwich bots.

What Are Sandwich Bots?

A sandwich bot (which falls under the category of MEV bots) is a crypto trading algorithm that independently generates profits through DEX price disparities.

It “sandwiches” or inserts a trader’s transaction between two of its own trades to profit from price movement, specifically by placing buy and sell orders at strategic moments.

Here’s how it works: The bot regularly scans pending transactions on the blockchain. When it sees a large trade waiting to go through, it quickly places a buy order just before it, pushing the price up.

The above price triggers the original trader transaction, and, at the very same moment, the bot sells its assets at a profit. All this is normally done in milliseconds and lets the bot extract the price slippage to generate gains at low risk.

Because decentralized exchanges are built on transparent blockchain transactions, sandwich bots can scan for these profitable moments in real time.

Sandwich bots have become a standard practice among many traders and businesses due to the automated means of generating profits without interference.

They guarantee profit potential, are available 24/7, react faster, and strengthen trader’s positions in the market.

However, their use is highly controversial: some find them quite ingenious for trading, while others claim they are a means of unfair price manipulation. And in some jurisdictions, they might even be in a legal gray area.

An Example of Crypto Sandwich Trading Bot

Let’s say a certain trader wants to buy 50 ETH on a decentralized exchange via a market order. Since the nature of DEX transactions is public before they get confirmed, a sandwich bot notices his/her trade in the mempool. Here’s what goes down next:

- The Bot Spots the Trader’s Deal. The bot notices that the trader is going to buy 50 ETH, which will slightly force the price up due to slippage.

- Front-Running (Buying First). The bot immediately places a buy order of ETH in front of the trader’s deal, pushing up the price.

- The Trade Gets Executed. The trader’s order goes through, but because of the bot’s earlier buy order, they have to buy ETH at a slightly higher price.

- Back-Running. Back-running means profiting through the sale. Immediately following the main transaction, the bot instantly sells the just-bought ETH for a higher price, which guarantees a certain profit.

This entire process happens in the blink of an eye, and the bot continues looking for more opportunities to repeat the cycle.

For traders operating on DEX, however, “sandwiches” become an irritant since they always end up paying more than anticipated. This is why some traders use private transactions or slippage controls to avoid getting “sandwiched.”

Why Invest in a Custom Sandwich Bot?

If you are fully dedicated to crypto trading, then making your own sandwich bot can give you a quantum leap.

To begin with, a custom bot helps you get the highest returns. It moves fast and snatches the price opportunities in the best way ever before they vanish. With it, each trade will be as profitable as possible because it is executed with precision.

Of course, you are also free to decide for yourself how the bot works, be it selecting target tokens or setting your risk levels. Basically, you get to set everything up to exactly match your plans with no forcing of strategy into some one-size-fits-all bot.

Second, your cryptocurrency sandwich bot will continuously be on, running 24/7, watching the blockchain for trade and immediately catching the moment.

This option saves you from having to be stuck in front of the screen all the time and instead concentrate your energy on other, perhaps more meaningful, aspects of the process.

Not to mention, custom bots have better protection: developers usually take care of encrypted transactions and regular updates to keep them safe and updated.

Finally, despite the fact that a custom bot requires much to be built, it pays more in returns over time, unlike subscription bots that have endless fees or share revenue.

Must-Have Features of a High-Performing Sandwich Bot

A high-performance sandwich bot must be lightning-fast, every millisecond will count in identifying and executing a trade. The faster it acts, the greater the chances of its profit.

But speed alone isn’t enough. A smart bot also mandates prudent algorithms that could prognose price movements, calculate slippage, and figure out the best times to buy and sell.

Of course, not every trader acts the same way, which is why a bot should let you tweak settings to match your crypto trading strategy, whether that means amending slippage tolerance, going after specific tokens, or administering your risks.

The third important criterion concerns availability. With live monitoring, the bot can watch blockchain transactions as they pop up. Still, since blockchain transactions are public, a bot must also govern private transactions to prevent other bots from front-running your trades.

Next comes asset protection accompanied by risk management. A truly good bot should have built-in stop-loss settings, slippage limits, and trade size caps to help keep losses low. And because the crypto market never stays still, the bot must remain adaptable and adjust itself when market conditions switch up.

And finally, despite the fact that the bot does all the hard work, it nonetheless must be easy to use. So make sure no feature confuses you so as not to make silly mistakes at the most inopportune moment.

How to Develop a Crypto Sandwich Trading Bot: A Step-by-Step Guide

From the technical point of view, building your own crypto trading bot is undeniably complicated. Still, if you split the development process into smaller, more handleable stages, it can be a much simpler undertaking.

1. Decide What Kind of Work You Want Your Bot to Do

Before even starting to code, put some thought into what you want to achieve with your bot. Are you focused on certain tokens? Want to minimize slippage? Need the bot to trade within particular ranges of prices? Knowing precisely what you need will help you shape how your bot works right from the start.

2. Pick Your Blockchain and Exchange

Since your bot will work on a decentralized exchange, decide which blockchain (Ethereum, Binance Smart Chain, etc.) and DEX you’ll be using. This choice will help you sort out the tools and frameworks you need to integrate.

3. Delegate the Development to a Software Partner

Since the technical side takes a lot of skill and time to master, it’s wiser to delegate the project to a software development partner. They’ll direct all the expert-level bits and pieces to get your bot in action.

First, they’ll set up your development environment, choosing the right tools and libraries. Then, they’ll connect your bot to the blockchain using wallets and APIs to interact with DEXs.

The next step is to implement mempool monitoring, so your bot can spot large transactions. Finally, they’ll develop the sandwich strategy—deciding when to buy and sell to profit from price movements, while organizing fees and slippage.

By working with an experienced partner, you can guarantee your bot is built right and ready to start trading.

4. Add Risk Control Features

The main idea of cryptocurrency trading is to make profits, but you definitely don’t want your bot running wild and blowing out your funds. The risk control features will help put the brakes on and make sure you don’t take hits larger than what you can afford.

5. Test and Debug

Before you start trading with real money, test your bot on the testnet, a simulation of the blockchain. That way, you will be able to ensure everything works just fine without risk to any funds. When you are confident enough, you could test it on smaller trades in a real market.

6. Watch Over Your Bot

Your bot is active, but the work isn’t over. You’ll need to watch its performance, troubleshoot problems, and update it when necessary. As market conditions change, you may want to amend its strategy to keep it functioning at its best.

Why Choose Our Development Team for Your Sandwich Bot?

When you’re ready to build your custom sandwich trading bot, you need a team that knows the ropes.

That’s where SCAND comes in. With years of experience in software development, we’re the best crypto bot trading development company to create a fully customized bot that works just how you want it to.

We’ve been in blockchain software development since its inception, so we know how to make your sandwich bot work on decentralized exchanges (DEXs) and interact with smart contracts.

Building the bot is, however, just the beginning—we’re in it for the long haul. Our blockchain developers can help you fine-tune and upgrade your bot so it keeps performing at its best.

All in all, we’ve got a proven track record of making pro-level software solutions, so you can count on us to ensure the bot is fast, glitch-free, and set up just right to match your trading strategy.

Legal and Ethical Considerations for Sandwich Bot Development

When you’re diving into crypto trading bot development, it’s important to think about the legal and ethical side of things. Even though these bots are indeed suitable for trading, they also come with some legal and ethical considerations you can’t ignore.

Legal Aspects

The laws around crypto sandwich bot development can be a little quirky and vary by location. Laws about crypto trading differ depending on your country, so you’ll want to know whether or not there’s any special legislation you’ll have to adhere to.

For instance, sandwich attacks might be considered as a sort of market manipulation in certain places, which could be legally problematic if not approached with care.

Note! In the United States, market manipulations are illegal under Section 9(a)(2) of the Securities Exchange Act of 1934. Similarly, the European Union prohibits market manipulation under Article 12 of the Market Abuse Regulation. Australia and Israel also have laws banning market manipulation.

Also, if your bot collects any personal data or interacts with other users, you’ll need to be aware of privacy policies. Remember that staying transparent with data and keeping things legit is the way to go.

Lastly, don’t forget to check the terms of service of the decentralized exchanges (DEXs) you’re using. Some platforms have rules about automated trading bots, and ignoring those could lead to your bot getting banned or even some legal issues.

Ethical Considerations

Even though you choose to work in the area where sandwich bots are legal, there’s still the ethical side to think about. One of the main concerns is unfair trading practices. Some people argue that sandwich bots and front-running bots exploit price differences in ways that are dishonest to other traders, especially those who don’t have access to the same tech.

Another issue is front-running—when your bot makes a trade based on information about someone else’s transaction before it’s processed. While this is common in high-speed trading, many see it as unethical because it takes advantage of other traders.

To keep things on the up and up, it’s important to be open and unbiased about how your bot works and make sure you’re not “hacking” the system to deceive others. The goal is to use your bot as a tool to reinforce your trading strategy without hurting the overall mechanics of the market.

FAQ

How do sandwich bots work?

A sandwich bot watches for big trades waiting to be confirmed on the blockchain. When it spots a large transaction, it buys the asset just before that trade goes through, pushing the price up. Then, after the trade happens and the price jumps, the bot sells its position for a quick profit.

Are sandwich bots legal?

It depends on where you’re located and which platform you use. In some places, using a sandwich bot might be seen as market manipulation or front-running, which can get you into legal trouble. It’s always best to check local laws and the rules of the exchange you’re on to be 100% sure you’re on the right side of the legislation.

Why should I develop a custom sandwich bot instead of using a pre-made one?

A custom sandwich bot is always built to match your exact wants, meaning you can adjust trading strategy and risk management as you see fit. Pre-made bots are usually a one-size-fits-all solution, so they might not give you the freedom or control you want. With a custom bot, you take the driver’s seat.

How long does it take to develop a custom sandwich bot?

It depends on how complicated you want the bot to be. On average, it can take a few weeks to a couple of months to make and test a fully functional bot. After it becomes active, you’ll probably want to make tweaks over time, so there’s some ongoing work involved too.

What kind of performance can I expect from my sandwich bot?

If built and optimized correctly, your sandwich bot should be fast and execute trades in a split second. A good bot will also have risk control mechanisms to help protect your investments.

Can I use a sandwich bot on any crypto exchange?

Sandwich bots usually work on decentralized exchanges (DEXs), such as Uniswap or PancakeSwap, which run on blockchains like Ethereum or Binance Smart Chain. But not all exchanges allow trading bots, so you must double-check their terms of service to confirm it’s allowed.

Can I track my sandwich bot’s performance?

Yes, you can watch your bot’s performance through a dashboard or by connecting it to analytics tools. Keeping an eye on how it’s doing will help you amend settings if needed and make it work as you want it to.