French startup Indy has just lately closed a brand new funding spherical of $44 million (€40 million) with BlackFin Capital Companions main the spherical. Indy began as an automatic accounting platform for freelancers and different self-employed folks.

However the firm has been slowly iterating on its product to turn into an all-in-one platform for freelancers, from accounting to firm creation, tax preparation, invoicing and (quickly) enterprise banking. It’s an attention-grabbing instance of the constructive results of bundling in a software-as-a-service firm. And it might encourage different entrepreneurs addressing a extremely fragmented market of potential prospects.

So long as you’re operating an organization with none worker, Indy needs to supply all the executive and finance instruments that you want to run your enterprise. It’s designed for freelancers, self-employed folks, medical doctors, architects, legal professionals, and many others.

Different buyers within the current funding spherical embrace La Maison and iXO. Indy closed its funding spherical this summer time. Whereas the startup didn’t wish to share its valuation, the corporate mentioned that it’s increased than the corporate’s valuation after its earlier €35 million funding spherical ($38.3 million at in the present day’s change fee).

Picture Credit: Indy

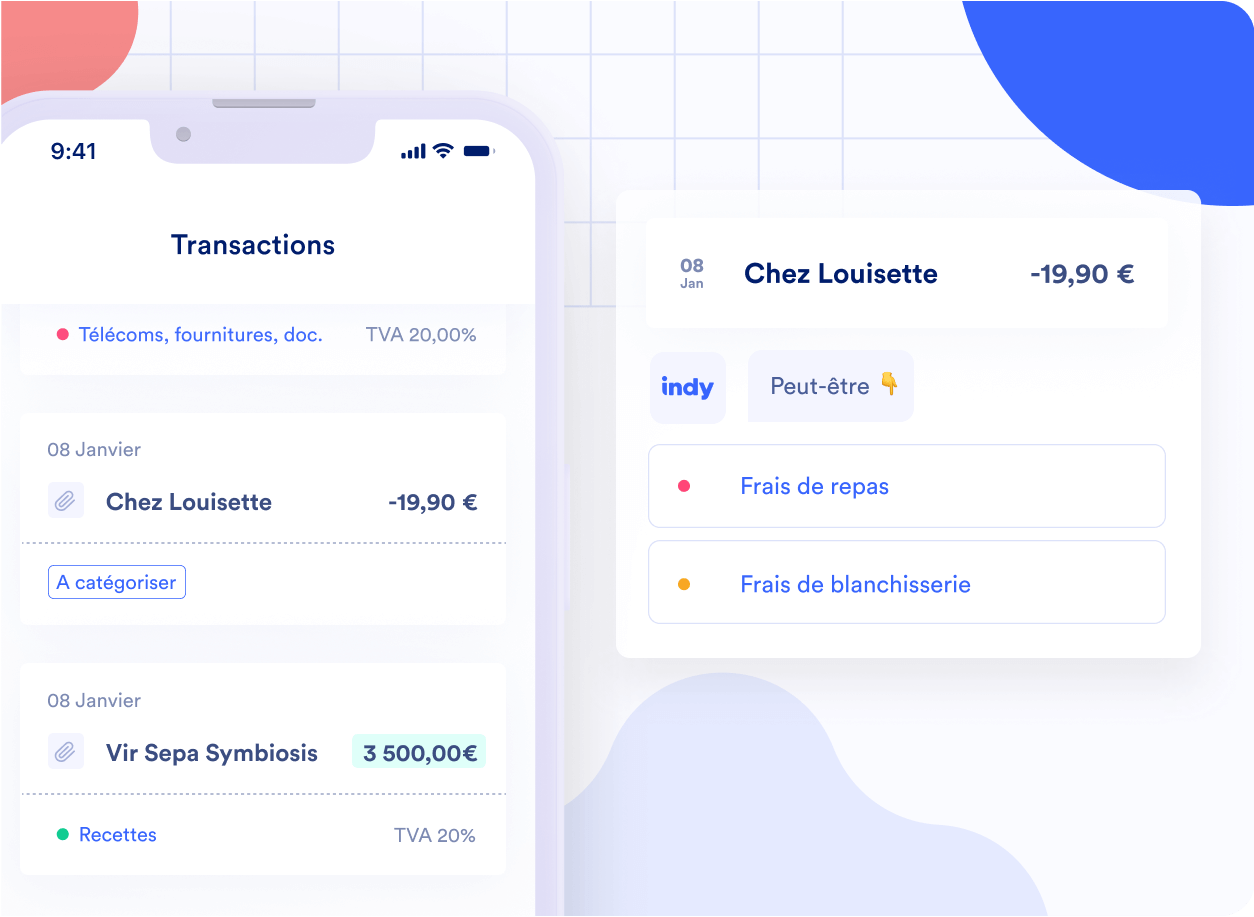

Indy’s core function stays its automated accounting function. While you create an account, you may mechanically begin synchronizing your checking account with Indy in order that previous and future transactions are mechanically fetched.

After that, Indy tries to categorize every transaction mechanically. In some instances, customers have to point the kind of transaction within the app. Prospects add a receipt to every transaction — VAT is mechanically detected and receipts are then mechanically archived and can be utilized within the occasion of a tax audit.

On the finish of the 12 months, Indy can pre-fill tax kinds and ship them to the company tax administration straight. Equally, Indy handles VAT returns.

Indy’s accounting instruments are free to make use of endlessly. As quickly as you wish to generate tax kinds and submit them, you must pay a month-to-month subscription. Nevertheless it stays less expensive than hiring an accountant.

“As we’re on common 4 to 5 occasions cheaper than a chartered accountant for the tax preparation half, there are lots of people who find themselves utilizing our free companies and who may even subscribe to our paid companies. Nevertheless it’s as much as them, they will additionally determine to rent an accountant,” Indy co-founder and CEO Côme Fouques advised me.

Product bundling playbook

With this straightforward product positioning, Indy managed to persuade tens of hundreds of paid subscribers. However the firm hasn’t been standing nonetheless because it rolled out different merchandise to show Indy right into a product suite.

For example, now you can create quotes and invoices from Indy and retailer them in your person account. In fact, you may at all times use Phrase or Excel for these paperwork, however there are some advantages in having these paperwork in Indy straight. For example, when a shopper pays an bill with a financial institution switch, Indy can mechanically mark an bill as paid.

Equally, earlier than you should utilize a product like Indy, you really need an organization to invoice prospects. In France, even when you’re a part-time freelancer in search of extra revenue, there may be some paperwork concerned and there are a number of choices.

The startup helps you make the correct choices once you create your organization. In contrast to conventional firm creation companies, Indy affords this service at no cost so long as you begin a subscription — however you may cancel that subscription everytime you need.

These merchandise improve the product stickiness and customers usually tend to suggest Indy to different self-employed folks. Equally, the gross sales funnel works notably nicely as a great portion of people that wish to turn into freelancers must decide an organization creation service first.

The subsequent step is obvious: Indy goes to turn into a fintech startup. In just some months, the startup will provide a free enterprise checking account with a fee card. As soon as once more, it is smart to bundle this service as present prospects have to change between their banking app and Indy to regulate their enterprise funds.

Present corporations engaged on enterprise banking, equivalent to Qonto and Shine in France, focus closely on small and medium corporations. They don’t have a primary product providing with primary options that may work nicely for freelancers. “Enterprise banking for a self-employed individual is fairly primary — they wish to ship cash by way of a switch, obtain cash by way of a switch, have a fee card, and that’s all there may be to it,” Fouques mentioned.

And Indy can then leverage this fintech angle for different companies. For example, the corporate might provide new fee strategies for invoices, equivalent to on-line card funds, QR code-based funds or utilizing the smartphone as a contactless card reader.

“As we provide all these options in the identical service, we make large economies of scale and we lower your expenses on person acquisition prices,” Fouques mentioned. “This implies we will provide a complete vary of companies freed from cost — companies which might in any other case be paid companies elsewhere. On the similar time we have now a hyper-healthy, hyper-scalable mannequin.”

Some corporations have recognized the identical drawback within the U.S., equivalent to Discovered and Lili — they’ve each raised round $80 million based on Crunchbase knowledge. Indy isn’t going to compete head-to-head with these well-capitalized corporations. As a substitute, the French startup is taking a look at different European international locations to see if it could possibly replicate its service in different markets.

However Indy continues to be very a lot centered on its dwelling market as there are thousands and thousands of self-employed folks in France. The market alternative is already vital. And it seems like Indy has discovered the correct distribution technique.